does renters insurance cover water damage state farm

Although this may seem like an extensive list there may be other items that are covered with comprehensive coverage. Water damage caused by accidents involving plumbing or appliances is covered as is damage from frozen plumbing.

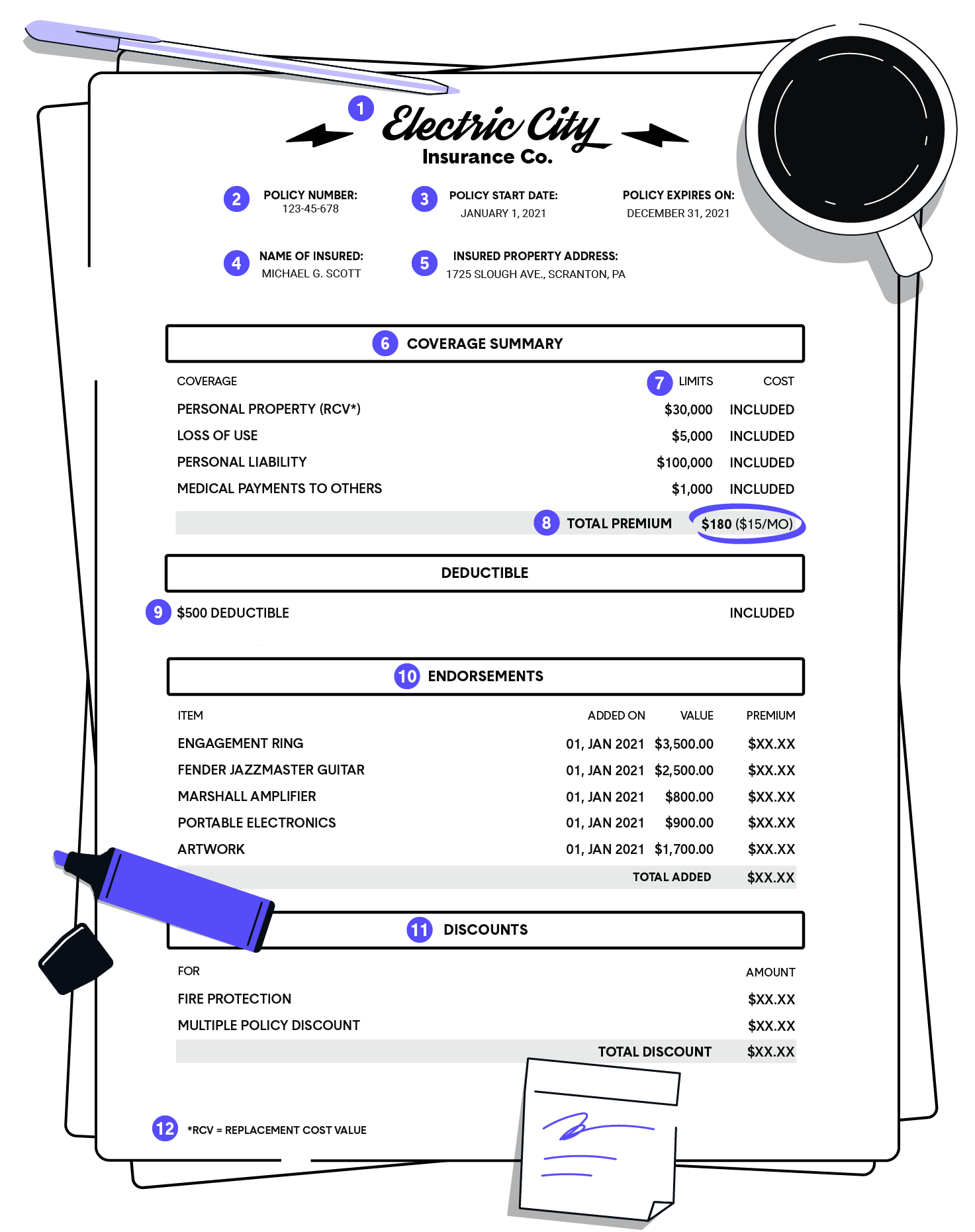

How To Read A Renters Insurance Policy The Zebra

This said if water rushes into your home because part of your roof is torn off during a tornado any resulting damage should be covered.

. Compare Plans and Prices For Free. Coverage for some of the most common causes of property damage and loss such as theft vandalism and fire is entirely up to you. Some of these include.

Sump pump failure and water backup coverage is. Water damage you cause to others. So should damage from ice dams which State Farm says are typically covered Ice dams form at the edge of a roof when water and often snow.

The physical dwelling. File a police report. It all depends on the type of water damage.

After many legal battles and much back and forth carriers have finally started to change this language to make it clearer. However renters insurance virtually never covers flooding which is common during a hurricane. Both insurance companies have an A rating from AM Best.

Read on to find out if renters insurance covers water damage. Like water damage insurance for a home you own renters insurance doesnt cover all types of water damage. Depending on the type of water damage renters insurance can protect your property and personal belongings making it a valuable investment.

The insurance policy will usually state the potential sources of water leaks and accidental discharges that will be considered. You will still need to provide regular maintenance and always check for. However damage from.

Here at Wheeler DiUlio Barnabei we agree and have hotly contested the true definition of long term and repeated in court. A standard renters insurance policy will typically include the following. The good news is that State Farm renters insurance policies should cover theft.

Thus if your washing machine should malfunction or a pipe should burst and cause damage you can claim for the loss of your personal property. When it comes to sewer backup your renters insurance most likely wont cover damage caused by this type of event. Is your property damaged from water.

A leaking air conditioning unit. Read on to find out if renters insurance covers water damage. Geico and State Farm offer renters insurance with standard coverage plus the option for add-ons.

Find the Best Plan for Your Personal Property. Renters insurance can reimburse or replace your belongings when theyre lost or destroyed in a covered peril. Originally a standard homeowners policy covered only the risk of fire.

Coverage under a homeowners policy. Renters insurance provides excellent coverage for both you and your property while you live in a rented space. Submit a claim with the liable drivers auto insurance company.

Yes State Farm RV Insurance cover water damage. Todays homeowners policies provide protection against a number of the perils of modern life in one package policy. A leaking water heater.

In most cases damage due to water discharge or accidental. If your sink tub or washing machine accidentally overflows or an. By choosing comprehensive RV insurance with State Farm your RV will be protected from vehicle theft and damage caused by fire wind hail flood and even water damage.

The Service Line Coverage protects. For example renters policy may cover belongings damaged by the following types of water events. If your apartment is damaged by water your renters insurance may be able to help you cover the costs of replacing your belongings.

See reviews photos directions phone numbers and more for Zanetta Glover State Farm Insurance Agent locations in Newark NJ. As an affiliate of New Jersey Skylands Insurance and other major insurance companies PRIME Insurance provides an extension to your standard homeowners policy so that you are covered for expensive excavation and repair work in relation to underground wiring piping and any attached devices. Ad Get Your Free Quote Learn About All The Discounts Available To You.

Renters insurance covers your personal belongings damaged by water --- it does not cover damage to the dwelling structure thats covered by your landlords policy. A renters insurance policy covers you in some situations when water damages your belongings. So does State Farm RV insurance cover water damage.

In most cases it includes radiators plumbing and air-conditioning. Ad Call Your Local State Farm Agent Jim Malay For Your Quote Now. Your policys covered perils also called named perils and perils insured against will be clearly outlined in your policy itself.

State Farm ties. Covered perils in a renters policy typically include. The price of your State Farm renters insurance policy depends on the information you provide when getting a quote but a policy with 30000 in personal property coverage costs about 12 a month.

Does State Farms renters insurance cover water damage. The events or losses that are covered in your policy are called named perils. A typical homeowners policy 2 can provide insurance protection for the following.

Without renters insurance you may have to bear the financial burden of a loss on. Many insurers now define long term and repeated seepage as occurring for a period. If your mailbox has been damaged from a vehicle crash that you witnessed get the drivers contact and insurance info.

In short renters insurance covers what you own. Any perils excluded from coverage will also be listed. Purchase a new mailbox that is comparable to the damage one and keep your receipt for insurance reimbursement purposes.

A leaking or burst pipe. Non-flood related water damage. If there is a hurricane where you live your State Farm renters insurance should cover damages caused by it.

AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY. State Farm Water Damage Coverage Typically Covers Ice Dams. Ad Affordable Renters Insurance Plans Thats Customized To Your Needs.

Most landlords insurance covers only the building and damages due to negligence. Water damage can destroy heirlooms expensive electronics books clothing and more leaving you with thousands of dollars in losses. There are many things that are covered under the comprehensive coverage of most policies.

Hail water or flood. Contact with an animal such as a deer.

Does Homeowners Insurance Cover Water Damage Homeowners Insurance Homeowner Insurance

Average Cost Of Renters Insurance In 2022 Quotewizard

State Farm Renters Insurance Review Clearsurance

:max_bytes(150000):strip_icc()/Renters-insurance-4223009-final-a125edb41c2f4a4a980ef2cf069d7723.png)

A Comprehensive Guide To Renters Insurance

Photography Japan Earthquake Tsunami Japan

Is Renters Insurance Worth It Renters Insurance Budget Mom Renter

Hail Storm Hits Madrid Hail Storm Beautiful Disaster Storm

Will Renters Insurance Cover Water Damage American Family Insurance

/Renters-insurance-4223009-final-a125edb41c2f4a4a980ef2cf069d7723.png)

A Comprehensive Guide To Renters Insurance

4 Insurance Types Offered Auto Insurance Homeowners Insurance Renters Insurance Health Insurance Insur Renters Insurance Best Insurance Car Insurance

How To Cancel Your Renters Insurance Policy Quotewizard

All You Need To Know About Renters Insurance In Indiana

How To File A Renters Insurance Claim In 2022 U S News Renters Insurance Us News

State Farm Renters Insurance Review Pros Cons Pricing And Features

Does Renters Insurance Cover Flood Damage

Does Renters Insurance Cover Water Damage From A Toilet Rentswift

Does Renters Insurance Cover Water Damage Valuepenguin

7 Smart Home Devices That Could Pay Off When You Sell Smarthome Tech Gadgets Realestate Smart Home Home Selling Tips Home Buying